CBS News Live

CBS News Boston: Local News, Weather & More

CBS News Boston is your streaming home for breaking news, weather, traffic and sports for the Boston area and beyond. Watch 24/7.

Watch CBS News

The school earlier warned students that police have the right to respond.

Here's everything you need to know about the New England Patriots heading into the NFL draft.

Tyler Herro had 24 points and 14 assists, hitting six of Miami's franchise playoff-record 23 3-pointers, to lead the Heat to a 111-101 victory over the Boston Celtics on Wednesday night and tie their first-round playoff series at one game apiece.

Brad Marchand broke a tie midway through the third period and the Boston Bruins beat the Toronto Maple Leafs 4-2 on Wednesday night to take a 2-1 lead in the first-round playoff series.

Ever since TikTok Shop launched last year, users started buying products directly through the app, and now it means millions of dollars for small and medium sized business all over the country.

Quincy City Council President Ian Cain and Swansea attorney John Deaton are seeking the Republican nomination to run against Sen. Elizabeth Warren.

Massachusetts fruit farmers are bracing for a series of cold nights that could put their crops in jeopardy of dying off. But farmers have plans to save their crops.

Drummer Roger Wonson celebrated his 100th birthday by playing with his band Voltage at his senior living facility on Wednesday.

Glaciers are at serious risk from climate change. Melting glaciers have the potential to endanger coastlines in Massachusetts.

A look at the timeline of events in Karen Read's high-profile murder trial.

Aidan Kearney, the blogger known as "Turtleboy," is a key figure in the Karen Read trial.

Karen Read is charged with killing her boyfriend, Boston police officer John O'Keefe.

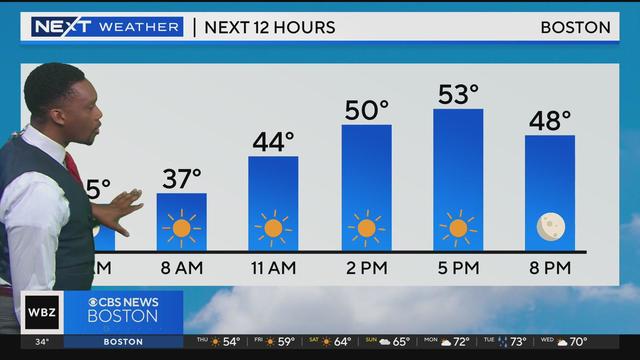

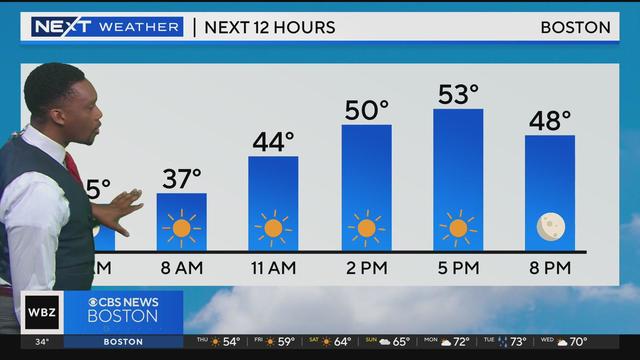

Jason Mikell has your latest weather forecast.

We made it to NFL Draft day! The Patriots own the third overall pick and are expected to take a quarterback with the selection, but which one will they draft to lead the franchise into the future? Michael Hurley breaks down all the options!

Eric Fisher has an updated weather forecast.

Both the Bruins and Celtics had playoff games at the same time, leaving fans with a tough choice. WBZ-TV's Brandon Truitt reports.

A driver was injured in a possible road rage shooting on I-93 in Braintree. WBZ-TV's Beth Germano reports.

Jason Mikell has your latest weather forecast.

What could be more "April" than this in Boston ... Freeze warnings and 80 degrees in the same 7-day forecast!

A Townsend woman was scammed into believing a famous actor was in love with her. Then the case took on a potentially more sinister turn.

State contracts obtained by the I-Team show taxpayers are paying tens of millions of dollars to hotels for rooms and food.

The CDC is keeping a close eye on the impact that rising heat is having on o

The CDC has issued an advisory about the risks of safely injecting Botox after some people have gotten so sick they had to be hospitalized.

Here's everything you need to know about the New England Patriots heading into the NFL draft.

For the majority of the last two-plus decades, Patriots fans were left waiting until the end of the first round on draft night. That will not be the case Thursday night.

Brad Marchand broke a tie midway through the third period and the Boston Bruins beat the Toronto Maple Leafs 4-2 on Wednesday night to take a 2-1 lead in the first-round playoff series.

Tyler Herro had 24 points and 14 assists, hitting six of Miami's franchise playoff-record 23 3-pointers, to lead the Heat to a 111-101 victory over the Boston Celtics on Wednesday night and tie their first-round playoff series at one game apiece.

Connor Wong homered twice and Rafael Devers connected for a homer in his return to Boston's lineup, sending the banged-up Red Sox to an 8-0 win over the Cleveland Guardians on Wednesday night.

The hits just keep coming for the Red Sox rotation, as Brayan Bello has joined the list of walking wounded.

Mason Lohrei made his Bruins and NHL debut just over five months ago. On Wednesday, the 23-year-old defenseman will get his first taste of the NHL Playoffs.

Bruins head coach Jim Montgomery offered up some thoughts about that scheduling when speaking to the media on Wednesday.

ESPN looked at first-round picks at every position between 2000-19 to determine a success rate -- or hit rate -- at each position to get an idea of what the surest and riskiest bets are for teams looking to nail their top pick.

Believe it or not, according to data from the Tax Foundation, Massachusetts ranks better than 13 other states.

When WBZ-TV showed Boston Red Sox fans pictures of current players, few could name any of them.

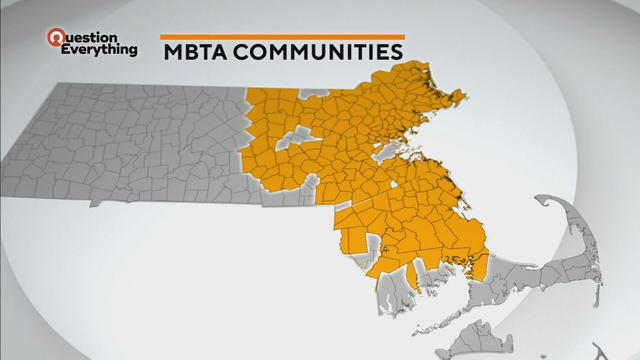

A law designed to ease the housing crunch in Massachusetts is turning into a battle between the state and some communities.

In Falmouth, just down the road from the ferry that heads to Martha's Vineyard, is an aquarium that happens to be a piece of history on Cape Cod.

Ice cream lovers are coming from all over to Holy Cow Ice Cream Cafe for their homemade ice cream and unique flavors.

A Somerville business is bringing pinball players together as they get their nostalgia fix.

The CDC is keeping a close eye on the impact that rising heat is having on o

The CDC has issued an advisory about the risks of safely injecting Botox after some people have gotten so sick they had to be hospitalized.

Federal officials say they're double checking whether pasteurization has eradicated the danger from possible bird virus particles in milk.

Members of Gen-Z believe they are aging faster than other generations, but is that true?

Scientists are making progress in using less toxic immunotherapy instead of traditional chemotherapy to fight cancer.

A Townsend woman was scammed into believing a famous actor was in love with her. Then the case took on a potentially more sinister turn.

State contracts obtained by the I-Team show taxpayers are paying tens of millions of dollars to hotels for rooms and food.

A fourth-grade teacher at an elementary school in Cambridge is facing child rape charges.

William Foley Jr., a five-time drunk driver who lost his license after a fatal crash in 2001, is back behind bars after an I-Team investigation.

The IRS Criminal Investigation unit helps go after violent criminals, including some right here in Boston.

Quincy City Council President Ian Cain and Swansea attorney John Deaton are seeking the Republican nomination to run against Sen. Elizabeth Warren.

Pro-Palestinian students have accelerated their protests of the Israel-Hamas war. But are the they helping or hurting their cause?

Massachusetts State Sen. Peter Durant weighed in on budget concerns in Massachusetts.

According to ADL's annual Audit of Antisemitic Incidents, Massachusetts had the fifth most incidents in the country last year, up a shocking 189 percent over 2022.

"It's the golden goose," said Rooney of Boston's commercial property taxes, which provides a large percentage of the city's annual revenue.

April 20, 2024 is Record Store Day. See which record shops in Massachusetts are participating.

Boston Dynamics' latest robot is ready to "exceed human capabilities," the company says.

Rising costs are forcing small businesses located on Boston's Massachusetts Avenue to close.

Boston-based box wine brand Alileo teamed up with Caffe Nero to launch a coffee and wine experience in Massachusetts.

Today is Patriots' Day in Massachusetts. Here's what to know about the celebrations and what's open and closed for the holiday.

Researchers spotted a 37-year-old right whale mother named Wolf and her calf off the coast of Massachusetts.

The 2024 cicada broods will not be emerging in Massachusetts - but the buzzing bugs are set to appear here in 2025.

A pair of vultures thought to be "actively dying" actually had too much to drink, wildlife rescuers in Connecticut say.

A fluffy pile of golden retrievers took over the Boston Common in memory of Spencer the marathon dog.

The thick fog made for an eerie sight as the Mayflower II crossed the Cape Cod Canal.

Robert Shure is the talented sculptor behind the FAO Schwartz teddy bear, the Cy Young memorial and the Massachusetts Fallen Firefighters Memorial.

Ming Tsai demonstrates how to cook a traditional Chinese street food - Ming's bings.

Founded out of love, Rustic Marlin is a home décor and lifestyle brand with a unique origin story in Massachusetts.

The Vermont Country Store has since become an iconic destination for locals and tourists alike.

Creating an inviting environment for the community to meet, enjoy and participate in the arts

The school earlier warned students that police have the right to respond.

Drummer Roger Wonson celebrated his 100th birthday by playing with his band Voltage at his senior living facility on Wednesday.

The CDC is keeping a close eye on the impact that rising heat is having on o

The CDC has issued an advisory about the risks of safely injecting Botox after some people have gotten so sick they had to be hospitalized.

Ever since TikTok Shop launched last year, users started buying products directly through the app, and now it means millions of dollars for small and medium sized business all over the country.

Here's everything you need to know about the New England Patriots heading into the NFL draft.

For the majority of the last two-plus decades, Patriots fans were left waiting until the end of the first round on draft night. That will not be the case Thursday night.

Brad Marchand broke a tie midway through the third period and the Boston Bruins beat the Toronto Maple Leafs 4-2 on Wednesday night to take a 2-1 lead in the first-round playoff series.

Tyler Herro had 24 points and 14 assists, hitting six of Miami's franchise playoff-record 23 3-pointers, to lead the Heat to a 111-101 victory over the Boston Celtics on Wednesday night and tie their first-round playoff series at one game apiece.

Connor Wong homered twice and Rafael Devers connected for a homer in his return to Boston's lineup, sending the banged-up Red Sox to an 8-0 win over the Cleveland Guardians on Wednesday night.