I-Team: Solar Business Owner Faces Fraud Allegations, Interest From FBI

BOSTON (CBS) - The former owner of a New Hampshire-based solar business is accused of fraudulently transferring hundreds of thousands of dollars in company funds to his wife prior to filing for bankruptcy, the WBZ I-Team has learned.

The suspicious transactions by Bill Woods came at the same time customers of his now defunct Twin State Sun were beginning to complain about unfinished projects or deposits that had not been refunded, according to a new court filing by the bankruptcy trustee.

Woods and his company were the focus of an I-Team investigation in February. The following month, he filed for Chapter 7 bankruptcy to discharge a long list of consumer debts.

However, the ensuing probe of company finances has revealed evidence of fraud, according to a June filing by the trustee, Steven Notinger.

The WBZ I-Team has also learned a number of customers have received a visit from an FBI agent, who has asked questions about their failed solar projects.

Bankruptcy court documents accuse Woods of transferring more than $265,000 to his wife, Linda, over a five-month period from June to November 2016.

READ: Bankruptcy Court Documents

On July 1, Linda Woods paid cash for a $152,000 investment property in Newbury, N.H. Just one day earlier, court documents say she received a $100,000 payment from the company bank account.

The court documents also allege Bill Woods transferred $77,000 used to pay subcontractors for renovation work at the home.

The trustee has now moved to put an attachment on the home to prevent it from being sold and preserving it as an asset that can be used to repay creditors. It is currently listed online for $265,000.

Woods also used company funds as a down payment on a retirement property in Mexico, according to court documents.

"Woods engaged in what can be fairly described as a looting of Twin State Sun for his and (his wife's) personal purposes," the filing claims.

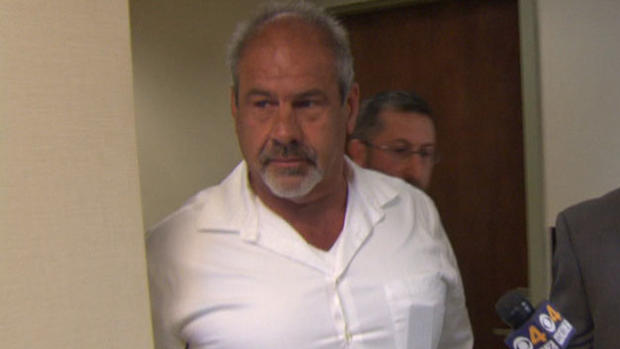

On Tuesday, the I-Team approached Woods after a bankruptcy meeting in downtown Manchester, N.H.

Woods did not answer any questions about the new allegations before getting on an elevator. His attorney also declined to comment.

Chris and Traci Byers attended the meeting. The Lowell homeowners first spoke with the I-Team about their unfinished solar project in January.

"I'm angry," Traci said. "It aggravates me to no end to see all these people who have been affected."

The Byers ended up paying more money out of pocket to get their project finished, but they lost valuable tax credits that help repay the cost of the pricey investment.

"He's never going to get away with this at this point," said Chris, adding he is glad investigators are closely following the money trail.

Jim Savage, a disabled Vietnam veteran, also attended Tuesday's meeting. The retiree told the I-Team he unknowingly signed documents that applied him for financing a solar project at his Worcester home last summer.

He never received any panels, but later discovered Twin State Sun had drained $53,000 in proceeds from the credit account when bills started arriving in the mail.

"I'd like to have a word or two with him," Savage said, adding that his credit score has been damaged while he has tried to erase the financial obligation for a project he never received.

Court documents indicate a number of other customers had similar experiences when they applied for financing through a company called GreenSky. Proceeds were supposed to be used by Twin State Sun to pay for project supplies and installation.

However, that did not happen in a number of cases.

"It appears there were no restrictions in 2016 to prevent Twin State Sun from unilaterally accessing a customer's proceeds once GreenSky approved the financing," court documents say.

Savage, who struggled to navigate the bankruptcy process so his claim could be added to the growing list of customers, offered some choice words for Woods.

"I think he ought to be put in jail for fraud," he said.

Ryan Kath can be reached at rkath@cbs.com. You can follow him on Twitter or connect on Facebook.