I-Team: Beware Of Student Loan Debt Relief Scams

BOSTON (CBS) - With an increasing number of college graduates shouldering enormous student loan burdens, consumer protection agencies are warning borrowers about a growing "cottage industry" of predatory debt relief companies.

Amelia Manni remembers getting a phone call from a company that knew she had taken out student loans to attend Boston University. The company, United Advisors Group (UAG), offered to lower her monthly payments. After 10 years, the $100,000 of debt Manni and her mom had amassed would be erased, the company promised.

"It sounded great," Manni told the I-Team. "They were lowering my payments by hundreds of dollars per month. Everything seemed legitimate."

Manni signed the contract and paid the initial fees. But several months later, she got some shocking news from her student loan provider.

"They said not a single payment had gone toward my debt and my loans were actually in deferment," Manni said.

UAG had taken over her account by signing a power of attorney document, which meant she wasn't receiving notification about her missed payments. Meantime, she had already paid $1,500 to the debt relief company.

"I was in a panic," the 24-year-old said. "It's scary to think that in three months you've given that much money and not a single dime of it has gone to your loans."

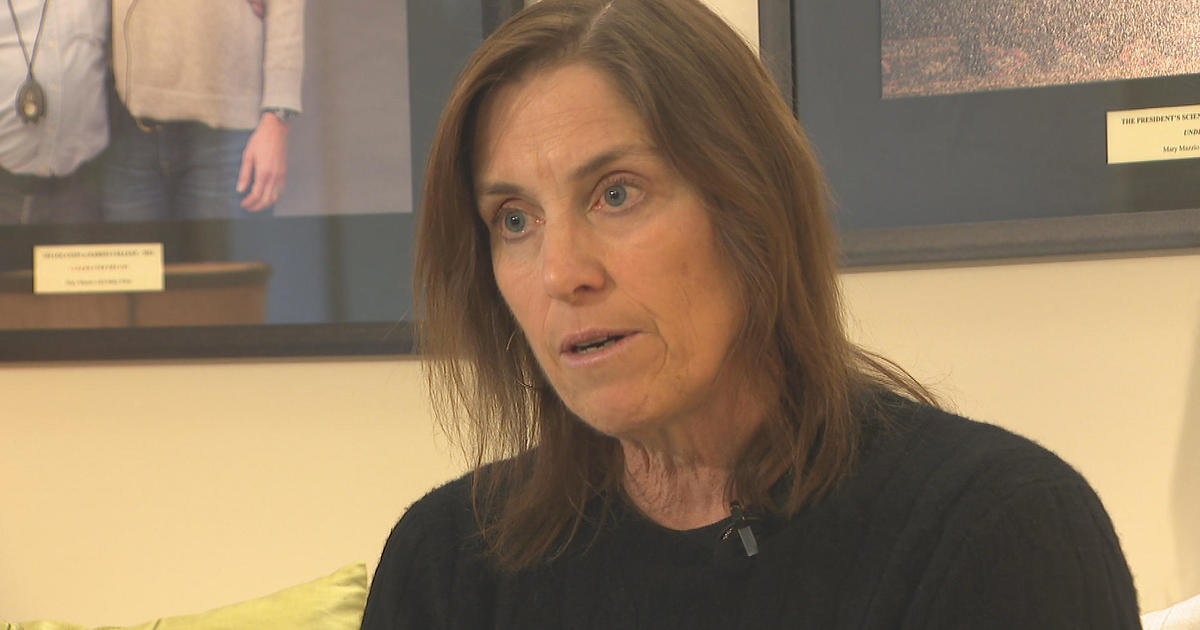

Tricia Muzerall knows the feeling.

Hoping for a higher-paying job, the 58-year-old pursued a business degree at Middlesex Community College several years ago.

Recently, she heard about an offer by Consumer Financial Assistance Group to lower her monthly payments. Just like Manni's experience, Muzerall said the written agreement sounded professional

She signed up and paid a $495 entry fee. But several months later, her loan provider also contacted her to ask why her payments had stopped.

"I knew something was definitely not right," Muzerall told the I-Team.

Calls to the financial agent who had assisted her went unreturned. Emails started bouncing back.

"They just took my money and ran," Muzerall recalled. "It was like they fell off the face of the Earth."

The I-Team visited the supposed office location of Consumer Financial Assistance Group in southern California, according to filings recorded with the state.

However, the business park in Irvine, Calif. displayed no sign for the company anywhere. Other employees at the location said they had never heard of it.

The company that took Manni's money, UAG, was also located in Orange County.

According to the Better Business Bureau, the company has an "F" rating, which includes dozens of similar complaints about the debt relief tactics.

When no one responded to a WBZ inquiry, the I-Team stopped by the office to get some answers. However, a manager refused to address any questions and threatened to call police.

The problem has prompted Attorney General Maura Healey to set up a student loan assistance unit to crack down on unlawful debt relief companies and help borrowers pursue repayment plans.

"This is a huge problem right now, not just for families in Massachusetts, but all across the country," Healey told the I-Team. "And it's a problem that is going to continue to grow."

Last year, Healey's office banned two debt relief companies from operating in Massachusetts as part of a settlement.

Healey said the companies have figured out how to aggressively market through social media to borrowers who are desperate to lower monthly payments.

But the Attorney General said college graduates need to know they should be able to negotiate with federal student loan providers without paying a dime.

"It's something they can get for free instead of paying some shady operator, who at the end of the day, isn't going to deliver and is only going to put them in a worse place," Healey said.

Both Manni and Muzerall contacted the Attorney General's office after realizing they had fallen for the scheme.

"I think it's disgusting that someone could do that to someone who's worked so hard," Muzerall said.

Luckily, both borrowers received full refunds for the fees they had paid the debt relief companies.

After a tough lesson learned outside the classroom, Manni shared this advice:

"I definitely would not go through any of those companies no matter what they say to you."

The Consumer Financial Protection Bureau issued an alert about avoiding student loan debt relief companies.

The advisory included these warning signs:

- Pressure to pay up-front fees

- Promises of immediate loan forgiveness or debt cancellation

- Demands you sign a "third party authorization" like a power of attorney form

- Request for personal information like a federal student aid PIN

Ryan Kath can be reached at rkath@cbs.com. You can follow him on Twitter or connect on Facebook.