CBS News Live

CBS News Boston: Local News, Weather & More

CBS News Boston is your streaming home for breaking news, weather, traffic and sports for the Boston area and beyond. Watch 24/7.

Watch CBS News

A Boston College professor thinks a rise in teen suicide, anxiety and depression are linked to limits on kids' freedom.

Massachusetts is well represented in the new list from U.S. News and World Report.

E-bikes are popping up everywhere in the Boston area and a man who loves them will let you ride one for a week for free.

Gov. Healey is knocking down a suggestion from her transportation secretary to consider tolls at the Massachusetts border.

Jury selection in the murder trial of Karen Read took place again Monday as the process nears completion.

Relatives were brought to their knees in the spot where Anthony Lopez was discovered Saturday night in Framingham's bustling Shoppers World plaza.

Inspired by protests at Columbia University, pro-Palestinian camps have been set up at MIT, Tufts and Emerson College.

Robert Kraft indicated he will no longer be donating to Columbia University as protests continue on campus.

A Townsend woman was scammed into believing a famous actor was in love with her. Then the case took on a potentially more sinister turn.

A look at the timeline of events in Karen Read's high-profile Massachusetts murder trial as she is charged with killing Boston police officer John O'Keefe.

Aidan Kearney, the Massachusetts blogger who goes by the name "Turtleboy," has become a key figure in the Karen Read murder trial.

Karen Read is on trial, charged with killing her boyfriend, Boston police officer John O'Keefe. Here's what to know about the trial.

Gov. Maura Healey does not support a suggestion by her own transportation secretary to add tolls to the Massachusetts border.

The Toronto Maple Leafs upped the physicality on the Bruins in Game 2 at TD Garden on Monday night and evened the playoff series with a 3-2 win. Now the Bruins have to answer in Game 3 in Toronto on Wednesday night. Will they? WBZ-TV's Dan Roche breaks it down, and discusses the goalie decisions by Jim Montgomery.

Several Massachusetts high schools were ranked among the best in the country.

Jason Mikell has your latest weather forecast.

Eric Fisher has an updated weather forecast.

A Townsend woman was scammed into believing a famous actor was in love with her. Then the case took on a potentially more sinister turn.

State contracts obtained by the I-Team show taxpayers are paying tens of millions of dollars to hotels for rooms and food.

Members of Gen-Z believe they are aging faster than other generations, but is that true?

Scientists are making progress in using less toxic immunotherapy instead of traditional chemotherapy to fight cancer.

Auston Matthews scored on a breakaway to snap a third-period tie with eight minutes left, and the Toronto Maple Leafs beat the Boston Bruins 3-2 on Monday night to knot their first-round playoff series at one game apiece.

Eliot Wolf is the Patriots' main decision-maker at the moment, but team president Jonathan Kraft is also reportedly "heavily involved" in the team's pre-draft process.

Want to know if it's going to be Swayman or Ullmark in net for the Bruins on Monday night? Jim Montgomery doesn't have an answer for you, but the B's head coach had plenty of jokes.

Less than a week after setting a new personal best at the 128th Boston Marathon, former Bruins captain Zdeno Chara dominated the London Marathon.

While there wasn't much drama for most of Celtics-Heat Game 1, things got pretty heated with just over a minute left when Jayson Tatum was hip-checked by Miami's Caleb Martin.

Wilyer Abreu had three hits and drove in two runs and the Boston Red Sox beat the Pittsburgh Pirates 6-1 on Sunday to complete a three-game sweep.

The Boston Celtics got off to the start they hoped for as they began their quest for the franchise's 18th championship on Sunday.

Red Sox first baseman Triston Casas could be sidelined for an extended period of time with a rib injury.

The New England Patriots are adding a familiar face to their staff.

Believe it or not, according to data from the Tax Foundation, Massachusetts ranks better than 13 other states.

When WBZ-TV showed Boston Red Sox fans pictures of current players, few could name any of them.

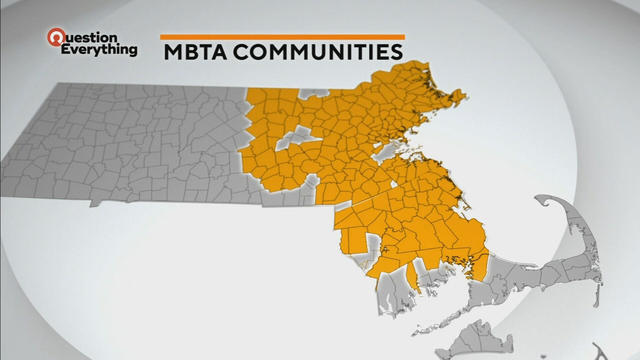

A law designed to ease the housing crunch in Massachusetts is turning into a battle between the state and some communities.

In Falmouth, just down the road from the ferry that heads to Martha's Vineyard, is an aquarium that happens to be a piece of history on Cape Cod.

Ice cream lovers are coming from all over to Holy Cow Ice Cream Cafe for their homemade ice cream and unique flavors.

A Somerville business is bringing pinball players together as they get their nostalgia fix.

Members of Gen-Z believe they are aging faster than other generations, but is that true?

Scientists are making progress in using less toxic immunotherapy instead of traditional chemotherapy to fight cancer.

The CDC estimates the U.S. could reach 300 measles cases in 2024 — more than the recent peak two years ago.

A new study finds that exercise may help reverse aging by reducing the buildup of fat.

Health officials are warning consumers not to consume Infinite Herbs basil sold at some Trader Joe's and Dierberg's stores after 12 people were sickened.

A Townsend woman was scammed into believing a famous actor was in love with her. Then the case took on a potentially more sinister turn.

State contracts obtained by the I-Team show taxpayers are paying tens of millions of dollars to hotels for rooms and food.

A fourth-grade teacher at an elementary school in Cambridge is facing child rape charges.

William Foley Jr., a five-time drunk driver who lost his license after a fatal crash in 2001, is back behind bars after an I-Team investigation.

The IRS Criminal Investigation unit helps go after violent criminals, including some right here in Boston.

Massachusetts State Sen. Peter Durant weighed in on budget concerns in Massachusetts.

According to ADL's annual Audit of Antisemitic Incidents, Massachusetts had the fifth most incidents in the country last year, up a shocking 189 percent over 2022.

"It's the golden goose," said Rooney of Boston's commercial property taxes, which provides a large percentage of the city's annual revenue.

MBTA General Manager Phil Eng gets high marks for improving the T's management and culture, but there's a lot of red ink that needs to be dealt with, says WBZ-TV's Jon Keller.

As Beacon Hill struggles to deal with a surge of homeless migrants, Governor Maura Healey finds herself dealing with another surge -- of political outrage over reports of migrant crime.

April 20, 2024 is Record Store Day. See which record shops in Massachusetts are participating.

Boston Dynamics' latest robot is ready to "exceed human capabilities," the company says.

Rising costs are forcing small businesses located on Boston's Massachusetts Avenue to close.

Boston-based box wine brand Alileo teamed up with Caffe Nero to launch a coffee and wine experience in Massachusetts.

Today is Patriots' Day in Massachusetts. Here's what to know about the celebrations and what's open and closed for the holiday.

The 2024 cicada broods will not be emerging in Massachusetts - but the buzzing bugs are set to appear here in 2025.

A pair of vultures thought to be "actively dying" actually had too much to drink, wildlife rescuers in Connecticut say.

A fluffy pile of golden retrievers took over the Boston Common in memory of Spencer the marathon dog.

The thick fog made for an eerie sight as the Mayflower II crossed the Cape Cod Canal.

A piece of decades-old military equipment washed up on a Cape Cod beach last week.

Ming Tsai demonstrates how to cook a traditional Chinese street food - Ming's bings.

Founded out of love, Rustic Marlin is a home décor and lifestyle brand with a unique origin story in Massachusetts.

The Vermont Country Store has since become an iconic destination for locals and tourists alike.

Creating an inviting environment for the community to meet, enjoy and participate in the arts

For over 85 years, Weston Theater Company has been creating engaging, entertaining, and inspiring theater.

U.S. News and World Report put out its annual list of top-ranked high schools, and Massachusetts is well represented.

Warmer weather is prime time for ticks that can carry Lyme disease and other illnesses. Here's how to spot them and get rid of them.

A Boston College professor thinks a rise in teen suicide, anxiety and depression are linked to limits on kids' freedom.

Karen, a "vibrant and beloved ostrich" at the Topeka Zoo, died after swallowing keys she nabbed from a staffer, the zoo announced on Facebook last week.

E-bikes are popping up everywhere in the Boston area and a man who loves them will let you ride one for a week for free.

Auston Matthews scored on a breakaway to snap a third-period tie with eight minutes left, and the Toronto Maple Leafs beat the Boston Bruins 3-2 on Monday night to knot their first-round playoff series at one game apiece.

Eliot Wolf is the Patriots' main decision-maker at the moment, but team president Jonathan Kraft is also reportedly "heavily involved" in the team's pre-draft process.

Want to know if it's going to be Swayman or Ullmark in net for the Bruins on Monday night? Jim Montgomery doesn't have an answer for you, but the B's head coach had plenty of jokes.

Less than a week after setting a new personal best at the 128th Boston Marathon, former Bruins captain Zdeno Chara dominated the London Marathon.

While there wasn't much drama for most of Celtics-Heat Game 1, things got pretty heated with just over a minute left when Jayson Tatum was hip-checked by Miami's Caleb Martin.