CBS News Live

CBS News Boston: Local News, Weather & More

CBS News Boston is your streaming home for breaking news, weather, traffic and sports for the Boston area and beyond. Watch 24/7.

Watch CBS News

Jury selection in the Karen Read murder trial is done for the week.

A JetBlue flight was forced to abort takeoff due to another aircraft attempting to cross the runway at Washington Reagan National Airport.

The 2024 cicada broods will not be emerging in Massachusetts - but the bugs are set to appear here in 2025.

A man who spent more than 20 years in prison for murdering two married Dartmouth College professors back in 2001 has been granted parole.

A Lowell teenager is being held pending a bail hearing for allegedly holding up a letter carrier in Nashua, New Hampshire.

Outdoor dining is returning to Moody Street in Waltham this year but the street won't be closed to traffic, leaving business owners in the area divided.

Mashpee has been named one of the best small towns in the northeast by USA Today readers.

Lowell is starting to put its new 25 mile per hour rule into effect on all downtown streets and those in dense neighborhoods.

High mortgages rates, high prices and low inventory are making homes tough to sell in Massachusetts.

A look at the timeline of events in Karen Read's high-profile Massachusetts murder trial as she is charged with killing Boston police officer John O'Keefe.

Aidan Kearney, the Massachusetts blogger who goes by the name "Turtleboy," has become a key figure in the Karen Read murder trial.

Karen Read is on trial, charged with killing her boyfriend, Boston police officer John O'Keefe. Here's what to know about the trial.

A JetBlue flight was forced to abort takeoff due to another aircraft attempting to cross the runway at Washington Reagan National Airport. WBZ-TV's Brandon Truitt reports.

Eric Fisher has your latest weather forecast.

In Watertown, a tenant will live in and help preserve the Browne House. WBZ-TV's Mike Sullivan reports.

Outdoor dining is returning to Moody Street in Waltham this year but the street won't be closed to traffic, leaving business owners in the area divided. WBZ TV's Tiffany Chan reports.

High mortgages rates, high prices and low inventory are making homes tough to sell in Massachusetts. WBZ TV's Laura Haefeli reports.

State contracts obtained by the I-Team show taxpayers are paying tens of millions of dollars to hotels for rooms and food.

A fourth-grade teacher at an elementary school in Cambridge is facing child rape charges.

A new study finds that exercise may help reverse aging by reducing the buildup of fat.

Health officials are warning consumers not to consume the Infinite Herbs basil sold at Trader Joe's after 12 people were sickened.

The Red Sox are back to .500 after an embarrassing 3-7 homestand.

Will it be Linus Ullmark or Jeremy Swayman in net when the Bruins begin their first-round series against the Toronto Maple Leafs on Saturday night at TD Garden?

The injury bug keeps biting the Boston Red Sox.

Eliot Wolf touched on a number of topics Thursday as he held his pre-draft chat with reporters at Gillette Stadium.

The Celtics' list of potential first-round opponents is down to just two. Boston will play either the Miami Heat or the Chicago Bulls when the postseason tips off at TD Garden on Sunday afternoon.

Tanner Houck pitched a three-hitter with nine strikeouts for Boston's first complete-game shutout at Fenway Park in nearly seven years, and the Red Sox beat the Cleveland Guardians 2-0 on Wednesday night.

It's no surprise that Jayson Tatum and Jrue Holiday will be back on Team USA this summer, but both Celtics stars were a bit surprised when Grant Hill showed up at their house with their jerseys.

When the New England Patriots pick third overall in next week's NFL Draft, former head coach Bill Belichick will be on TV to break down the selection.

Bill Belichick believes that he'll get another chance to coach in the NFL in 2025. But with no job on the sideline this year, the former Patriots head coach is reportedly getting set to spend the 2024 season on television.

When WBZ-TV showed Boston Red Sox fans pictures of current players, few could name any of them.

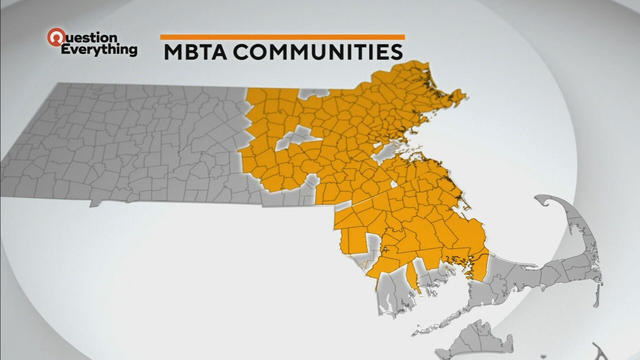

A law designed to ease the housing crunch in Massachusetts is turning into a battle between the state and some communities.

The blueish tint of LED headlights can make for a white-knuckle ride on roads in Massachusetts and beyond.

In Falmouth, just down the road from the ferry that heads to Martha's Vineyard, is an aquarium that happens to be a piece of history on Cape Cod.

Ice cream lovers are coming from all over to Holy Cow Ice Cream Cafe for their homemade ice cream and unique flavors.

A Somerville business is bringing pinball players together as they get their nostalgia fix.

A new study finds that exercise may help reverse aging by reducing the buildup of fat.

Health officials are warning consumers not to consume the Infinite Herbs basil sold at Trader Joe's after 12 people were sickened.

Mass General Hospital will add 94 inpatient beds by 2027.

Researchers in Singapore looked at whether or not plant-based meat alternatives provided the same health benefits as real meat.

A nonsurgical weight loss procedure may be more effective and less expensive than weight loss drugs like Ozempic.

State contracts obtained by the I-Team show taxpayers are paying tens of millions of dollars to hotels for rooms and food.

A fourth-grade teacher at an elementary school in Cambridge is facing child rape charges.

William Foley Jr., a five-time drunk driver who lost his license after a fatal crash in 2001, is back behind bars after an I-Team investigation.

The IRS Criminal Investigation unit helps go after violent criminals, including some right here in Boston.

A pet DNA testing company out of New Hampshire linked dog breeds to a human sample – twice.

According to ADL's annual Audit of Antisemitic Incidents, Massachusetts had the fifth most incidents in the country last year, up a shocking 189 percent over 2022.

"It's the golden goose," said Rooney of Boston's commercial property taxes, which provides a large percentage of the city's annual revenue.

MBTA General Manager Phil Eng gets high marks for improving the T's management and culture, but there's a lot of red ink that needs to be dealt with, says WBZ-TV's Jon Keller.

As Beacon Hill struggles to deal with a surge of homeless migrants, Governor Maura Healey finds herself dealing with another surge -- of political outrage over reports of migrant crime.

A new study of driving automation technology says 11 of 14 systems performed poorly under optimal road conditions.

Boston Dynamics' latest robot is ready to "exceed human capabilities," the company says.

Rising costs are forcing small businesses located on Boston's Massachusetts Avenue to close.

Boston-based box wine brand Alileo teamed up with Caffe Nero to launch a coffee and wine experience in Massachusetts.

Today is Patriots' Day in Massachusetts. Here's what to know about the celebrations and what's open and closed for the holiday.

Market Basket is considering appealing a federal jury's decision to award a New Hampshire man more than $134,000 in an age discrimination lawsuit.

The 2024 cicada broods will not be emerging in Massachusetts - but the bugs are set to appear here in 2025.

A pair of vultures thought to be "actively dying" actually had too much to drink, wildlife rescuers in Connecticut say.

A fluffy pile of golden retrievers took over the Boston Common in memory of Spencer the marathon dog.

The thick fog made for an eerie sight as the Mayflower II crossed the Cape Cod Canal.

A piece of decades-old military equipment washed up on a Cape Cod beach last week.

The Vermont Country Store has since become an iconic destination for locals and tourists alike.

Creating an inviting environment for the community to meet, enjoy and participate in the arts

For over 85 years, Weston Theater Company has been creating engaging, entertaining, and inspiring theater.

Surrounded by mountains, Kimpton Taconic is a boutique hotel offering both classic and highly curated experiences.

Learn how the strategic use of windows and harnessing the power of daylight can create space and comfort within a home.

There are 30 historic homes across New England that allow you to rent the home, so long as you help to preserve it.

Mary Mazzio aims to effect social change by focusing on what connects people.

Outdoor dining is returning to Moody Street in Waltham this year but the street won't be closed to traffic, leaving business owners in the area divided.

High mortgages rates, high prices and low inventory are making homes tough to sell in Massachusetts.

A Lowell teenager is being held pending a bail hearing for allegedly holding up a letter carrier in Nashua, New Hampshire.

The Red Sox are back to .500 after an embarrassing 3-7 homestand.

Will it be Linus Ullmark or Jeremy Swayman in net when the Bruins begin their first-round series against the Toronto Maple Leafs on Saturday night at TD Garden?

The injury bug keeps biting the Boston Red Sox.

Eliot Wolf touched on a number of topics Thursday as he held his pre-draft chat with reporters at Gillette Stadium.

The Celtics' list of potential first-round opponents is down to just two. Boston will play either the Miami Heat or the Chicago Bulls when the postseason tips off at TD Garden on Sunday afternoon.