CBS News Live

CBS News Boston: Local News, Weather & More

CBS News Boston is your streaming home for breaking news, weather, traffic and sports for the Boston area and beyond. Watch 24/7.

Watch CBS News

The Karen Read murder trial resumed on Wednesday with jury selection continuing for a second straight day.

Today is the final day to file your taxes in Massachusetts.

Rising costs are forcing small businesses located on Boston's Massachusetts Avenue to close.

A book with records of a U.S. Navy destroyer's trips during World War II was found in a piece of furniture far from the now-sunken ship.

Police are looking for three people who they said were involved in an armed robbery of a USPS mail carrier on Tuesday afternoon.

The Bruins have had the Maple Leafs' number in the playoffs, winning all three of their showdowns over the last 11 years.

After nearly two decades as the Boston Bruins play-by-play announcer on NESN, Jack Edwards has announced his retirement from his "dream job" following the 2023-24 postseason.

King is a very active and friendly boy who enjoys spending time with his peers and being outside.

A pair of vultures thought to be "actively dying" actually had too much to drink, wildlife rescuers in Connecticut say.

A look at the timeline of events in Karen Read's high-profile Massachusetts murder trial as she is charged with killing Boston police officer John O'Keefe.

Aidan Kearney, the Massachusetts blogger who goes by the name "Turtleboy," has become a key figure in the Karen Read murder trial.

Karen Read is on trial, charged with killing her boyfriend, Boston police officer John O'Keefe. Here's what to know about the trial.

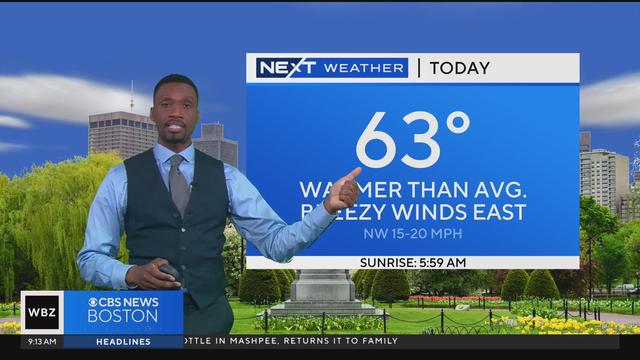

Jason Mikell has your latest weather forecast.

Dozens of people have been dismissed as jury selection continues in the Karen Read murder trial.

Neighbors told WBZ-TV the mail carrier later told them the robbers were after his master keys.

A postal worker was robbed at gunpoint in Nashua, police said.

Jason Mikell has your latest weather forecast.

State contracts obtained by the I-Team show taxpayers are paying tens of millions of dollars to hotels for rooms and food.

A fourth-grade teacher at an elementary school in Cambridge is facing child rape charges.

Researchers in Singapore looked at whether or not plant-based meat alternatives provided the same health benefits as real meat.

A nonsurgical weight loss procedure may be more effective and less expensive than weight loss drugs like Ozempic.

Bill Belichick felt confident that he was going to get a head coaching job with the Atlanta Falcons, but ESPN is reporting that a phone call from Robert Kraft may have sunk his chances.

The Bruins have had the Maple Leafs' number in the playoffs, winning all three of their showdowns over the last 11 years.

José Ramírez hit a tiebreaking RBI single in the 11th inning, and the Cleveland Guardians beat the Boston Red Sox 10-7 on Tuesday night.

The Ottawa Senators beat the Boston Bruins 3-1 on Tuesday night in the regular-season finale for both teams.

Buzunesh Deba, who lives in the Bronx, became the default winner of the 2014 Boston Marathon in 2016 when the first-place winner was disqualified for doping, but she says she has not yet received her prize money.

After nearly two decades as the Boston Bruins play-by-play announcer on NESN, Jack Edwards will retire from his "dream job" following the 2023-24 postseason.

With a win Tuesday, the Bruins would clinch the Atlantic Division and a first-round meeting with the Lightning. But would Boston prefer the alternative?

Blake Griffin announced his retirement Tuesday after a 14-year career that included six All-Star selections, Rookie of the Year honors and a dunk contest victory.

The Red Sox have some real big problems. Mainly, the team can't really hit and can't play something resembling good defense.

When WBZ-TV showed Boston Red Sox fans pictures of current players, few could name any of them.

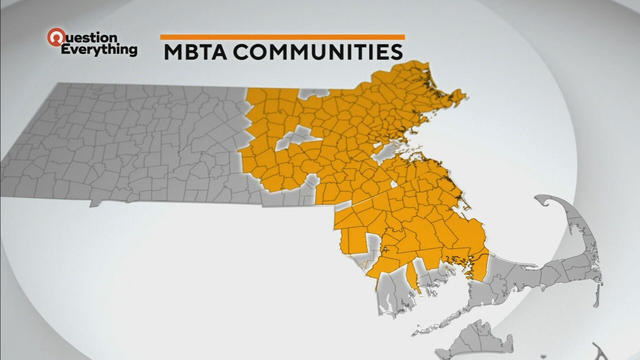

A law designed to ease the housing crunch in Massachusetts is turning into a battle between the state and some communities.

The blueish tint of LED headlights can make for a white-knuckle ride on roads in Massachusetts and beyond.

Ice cream lovers are coming from all over to Holy Cow Ice Cream Cafe for their homemade ice cream and unique flavors.

A Somerville business is bringing pinball players together as they get their nostalgia fix.

The Recovery Center of America in Westminster, Massachusetts has a program to help first responders and veterans suffering from addiction.

Researchers in Singapore looked at whether or not plant-based meat alternatives provided the same health benefits as real meat.

A nonsurgical weight loss procedure may be more effective and less expensive than weight loss drugs like Ozempic.

The Boston Marathon weather forecast for Monday sounds glorious for spectators, but it may be too hot for the runners.

George Schappell and sister Lori, of Reading, Pa., were the world's oldest conjoined twins, according to the Guinness Book of World Records.

Temperatures that are too high or too low have been linked to death and disability due to stroke, researchers say.

State contracts obtained by the I-Team show taxpayers are paying tens of millions of dollars to hotels for rooms and food.

A fourth-grade teacher at an elementary school in Cambridge is facing child rape charges.

William Foley Jr., a five-time drunk driver who lost his license after a fatal crash in 2001, is back behind bars after an I-Team investigation.

The IRS Criminal Investigation unit helps go after violent criminals, including some right here in Boston.

A pet DNA testing company out of New Hampshire linked dog breeds to a human sample – twice.

According to ADL's annual Audit of Antisemitic Incidents, Massachusetts had the fifth most incidents in the country last year, up a shocking 189 percent over 2022.

"It's the golden goose," said Rooney of Boston's commercial property taxes, which provides a large percentage of the city's annual revenue.

MBTA General Manager Phil Eng gets high marks for improving the T's management and culture, but there's a lot of red ink that needs to be dealt with, says WBZ-TV's Jon Keller.

As Beacon Hill struggles to deal with a surge of homeless migrants, Governor Maura Healey finds herself dealing with another surge -- of political outrage over reports of migrant crime.

A new study of driving automation technology says 11 of 14 systems performed poorly under optimal road conditions.

Rising costs are forcing small businesses located on Boston's Massachusetts Avenue to close.

Boston-based box wine brand Alileo teamed up with Caffe Nero to launch a coffee and wine experience in Massachusetts.

Today is Patriots' Day in Massachusetts. Here's what to know about the celebrations and what's open and closed for the holiday.

Market Basket is considering appealing a federal jury's decision to award a New Hampshire man more than $134,000 in an age discrimination lawsuit.

Take a look at some of the stores that will be closed for Easter in Massachusetts.

A pair of vultures thought to be "actively dying" actually had too much to drink, wildlife rescuers in Connecticut say.

A fluffy pile of golden retrievers took over the Boston Common in memory of Spencer the marathon dog.

The thick fog made for an eerie sight as the Mayflower II crossed the Cape Cod Canal.

A piece of decades-old military equipment washed up on a Cape Cod beach last week.

Everett police are asking if anyone recognizes a kitten with a "heart-shaped nose and strawberry dress."

The Vermont Country Store has since become an iconic destination for locals and tourists alike.

Creating an inviting environment for the community to meet, enjoy and participate in the arts

For over 85 years, Weston Theater Company has been creating engaging, entertaining, and inspiring theater.

Surrounded by mountains, Kimpton Taconic is a boutique hotel offering both classic and highly curated experiences.

Learn how the strategic use of windows and harnessing the power of daylight can create space and comfort within a home.

A book with records of a U.S. Navy destroyer's trips during World War II was found in a piece of furniture far from the now-sunken ship.

The Karen Read murder trial resumed on Wednesday with jury selection continuing for a second straight day.

The new single, titled "Primrose Hill", was recently released by James McCartney and Sean Ono Lennon, who are both musicians themselves.

A pair of vultures thought to be "actively dying" actually had too much to drink, wildlife rescuers in Connecticut say.

Today is the final day to file your taxes in Massachusetts.

Bill Belichick felt confident that he was going to get a head coaching job with the Atlanta Falcons, but ESPN is reporting that a phone call from Robert Kraft may have sunk his chances.

The Bruins have had the Maple Leafs' number in the playoffs, winning all three of their showdowns over the last 11 years.

José Ramírez hit a tiebreaking RBI single in the 11th inning, and the Cleveland Guardians beat the Boston Red Sox 10-7 on Tuesday night.

The Ottawa Senators beat the Boston Bruins 3-1 on Tuesday night in the regular-season finale for both teams.

Buzunesh Deba, who lives in the Bronx, became the default winner of the 2014 Boston Marathon in 2016 when the first-place winner was disqualified for doping, but she says she has not yet received her prize money.