CBS News Live

CBS News Boston: Local News, Weather & More

CBS News Boston is your streaming home for breaking news, weather, traffic and sports for the Boston area and beyond. Watch 24/7.

Watch CBS News

Gas prices are rising fast in Massachusetts and if you have a daily drive into Boston that extra expense adds up quick.

Highland Avenue in Somerville, Massachusetts is such a mess drivers are getting bumper stickers to show they "survived" it.

A different GOAT will be taking the field at Gillette Stadium this weekend, as Lionel Messi and Inter Miami CF are set to take over the house that Tom Brady built in New England.

Tom Brady's sloppy autographs on some prized items have allegedly cost a sports memorabilia collector in Massachusetts thousands of dollars.

A fifth day of jury selection is taking place Wednesday in the Karen Read murder trial, which is expected to get underway within days.

Looking to rent in Worcester? Apartment hunters have it tough in the central Massachusetts city.

A historian says current student protests lack achievable goals or an inspiring message.

The University of Maine has revealed a massive 3D printer that could one day help create affordable housing.

Izabella, who also goes by Izzy, is an inquisitive, outgoing, and outspoken girl in search of her forever family.

A look at the timeline of events in Karen Read's high-profile murder trial.

Aidan Kearney, the blogger known as "Turtleboy," is a key figure in the Karen Read trial.

Karen Read is charged with killing her boyfriend, Boston police officer John O'Keefe.

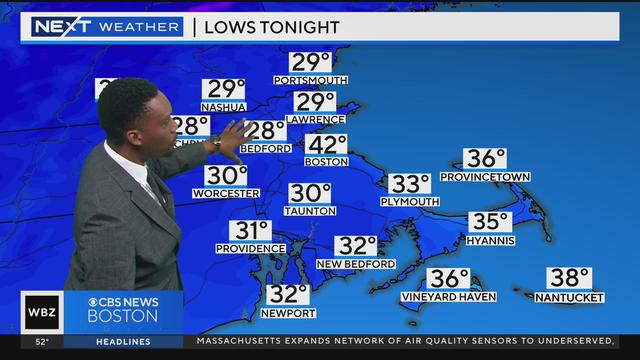

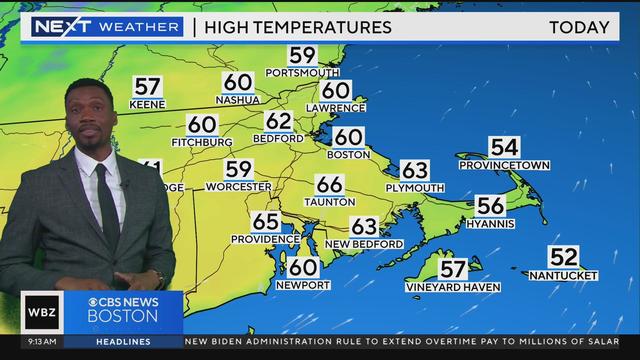

Jason Mikell has your latest weather forecast.

The University of Maine has unveiled the world's largest 3D printer that's four times bigger than it's predecessor.

Groups are rallying outside Steward Health Care facilities, hoping to save the hospitals from closing.

The debate was sparked from a recent interview on the Drew Barrymore show. Drew and Ross joined the Morning Mix to talk about where they fall in this debate.

Jason Mikell has your latest weather forecast.

A Townsend woman was scammed into believing a famous actor was in love with her. Then the case took on a potentially more sinister turn.

State contracts obtained by the I-Team show taxpayers are paying tens of millions of dollars to hotels for rooms and food.

Members of Gen-Z believe they are aging faster than other generations, but is that true?

Scientists are making progress in using less toxic immunotherapy instead of traditional chemotherapy to fight cancer.

ESPN looked at first-round picks at every position between 2000-19 to determine a success rate -- or hit rate -- at each position to get an idea of what the surest and riskiest bets are for teams looking to nail their top pick.

A different GOAT will be taking the field at Gillette Stadium this weekend, as Lionel Messi and Inter Miami CF are set to take over the house that Tom Brady built in New England.

Tyler Freeman and Bryan Rocchio had RBIs in the seventh inning when Cleveland finally scored against Boston's Tanner Houck, and José Ramírez homered as the Guardians kept up their scorching start with a 4-1 win over the Red Sox on Tuesday night.

Manager Alex Cora told reporters on Tuesday in Cleveland that Triston Casas suffered a rib fracture and will be out for a while.

The Boston Celtics are not a group to run away from a challenge or a confrontation.

Just a few days ahead of the NFL Draft, the Patriots have reportedly only received "laughable" offers for the third overall pick.

The developments with Zach Wilson provide a bit of a depressing reminder that having such a high pick in such a draft year guarantees absolutely nothing

Fans may be second-guessing the Bruins for switching to Linus Ullmark for Game 2, but Jim Montgomery isn't questioning his decision.

Auston Matthews scored on a breakaway to snap a third-period tie with eight minutes left, and the Toronto Maple Leafs beat the Boston Bruins 3-2 on Monday night to knot their first-round playoff series at one game apiece.

Believe it or not, according to data from the Tax Foundation, Massachusetts ranks better than 13 other states.

When WBZ-TV showed Boston Red Sox fans pictures of current players, few could name any of them.

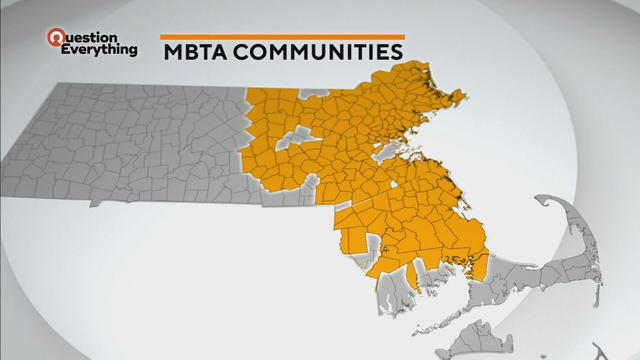

A law designed to ease the housing crunch in Massachusetts is turning into a battle between the state and some communities.

In Falmouth, just down the road from the ferry that heads to Martha's Vineyard, is an aquarium that happens to be a piece of history on Cape Cod.

Ice cream lovers are coming from all over to Holy Cow Ice Cream Cafe for their homemade ice cream and unique flavors.

A Somerville business is bringing pinball players together as they get their nostalgia fix.

Members of Gen-Z believe they are aging faster than other generations, but is that true?

Scientists are making progress in using less toxic immunotherapy instead of traditional chemotherapy to fight cancer.

The CDC estimates the U.S. could reach 300 measles cases in 2024 — more than the recent peak two years ago.

A new study finds that exercise may help reverse aging by reducing the buildup of fat.

Health officials are warning consumers not to consume Infinite Herbs basil sold at some Trader Joe's and Dierberg's stores after 12 people were sickened.

A Townsend woman was scammed into believing a famous actor was in love with her. Then the case took on a potentially more sinister turn.

State contracts obtained by the I-Team show taxpayers are paying tens of millions of dollars to hotels for rooms and food.

A fourth-grade teacher at an elementary school in Cambridge is facing child rape charges.

William Foley Jr., a five-time drunk driver who lost his license after a fatal crash in 2001, is back behind bars after an I-Team investigation.

The IRS Criminal Investigation unit helps go after violent criminals, including some right here in Boston.

Pro-Palestinian students have accelerated their protests of the Israel-Hamas war. But are the they helping or hurting their cause?

Massachusetts State Sen. Peter Durant weighed in on budget concerns in Massachusetts.

According to ADL's annual Audit of Antisemitic Incidents, Massachusetts had the fifth most incidents in the country last year, up a shocking 189 percent over 2022.

"It's the golden goose," said Rooney of Boston's commercial property taxes, which provides a large percentage of the city's annual revenue.

MBTA General Manager Phil Eng gets high marks for improving the T's management and culture, but there's a lot of red ink that needs to be dealt with, says WBZ-TV's Jon Keller.

April 20, 2024 is Record Store Day. See which record shops in Massachusetts are participating.

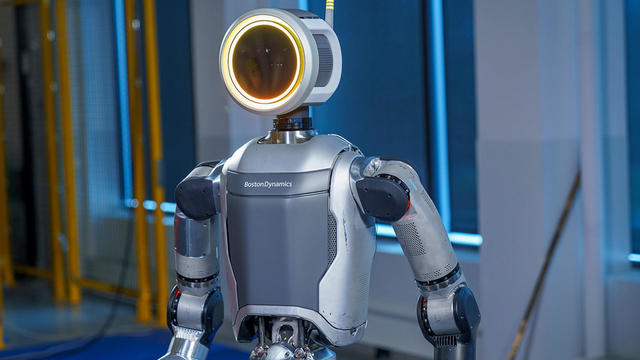

Boston Dynamics' latest robot is ready to "exceed human capabilities," the company says.

Rising costs are forcing small businesses located on Boston's Massachusetts Avenue to close.

Boston-based box wine brand Alileo teamed up with Caffe Nero to launch a coffee and wine experience in Massachusetts.

Today is Patriots' Day in Massachusetts. Here's what to know about the celebrations and what's open and closed for the holiday.

Researchers spotted a 37-year-old right whale mother named Wolf and her calf off the coast of Massachusetts.

The 2024 cicada broods will not be emerging in Massachusetts - but the buzzing bugs are set to appear here in 2025.

A pair of vultures thought to be "actively dying" actually had too much to drink, wildlife rescuers in Connecticut say.

A fluffy pile of golden retrievers took over the Boston Common in memory of Spencer the marathon dog.

The thick fog made for an eerie sight as the Mayflower II crossed the Cape Cod Canal.

Robert Shure is the talented sculptor behind the FAO Schwartz teddy bear, the Cy Young memorial and the Massachusetts Fallen Firefighters Memorial.

Ming Tsai demonstrates how to cook a traditional Chinese street food - Ming's bings.

Founded out of love, Rustic Marlin is a home décor and lifestyle brand with a unique origin story in Massachusetts.

The Vermont Country Store has since become an iconic destination for locals and tourists alike.

Creating an inviting environment for the community to meet, enjoy and participate in the arts

The University of Maine already had the world's largest 3D printer. It just unveiled a new one that's four times bigger.

Looking to rent in Worcester? Apartment hunters have it tough in the central Massachusetts city.

A fifth day of jury selection is taking place Wednesday in the Karen Read murder trial, which is expected to get underway within days.

An organization in Massachusetts is hoping to make their city a bit greener by giving out free trees.

Expanded federal overtime rule could result in employers paying workers an additional $1.5 billion, according to one estimate.

ESPN looked at first-round picks at every position between 2000-19 to determine a success rate -- or hit rate -- at each position to get an idea of what the surest and riskiest bets are for teams looking to nail their top pick.

A different GOAT will be taking the field at Gillette Stadium this weekend, as Lionel Messi and Inter Miami CF are set to take over the house that Tom Brady built in New England.

Tyler Freeman and Bryan Rocchio had RBIs in the seventh inning when Cleveland finally scored against Boston's Tanner Houck, and José Ramírez homered as the Guardians kept up their scorching start with a 4-1 win over the Red Sox on Tuesday night.

Manager Alex Cora told reporters on Tuesday in Cleveland that Triston Casas suffered a rib fracture and will be out for a while.

The Boston Celtics are not a group to run away from a challenge or a confrontation.