I-Team: What Taxpayers Need To Know When The IRS Wants To 'Verify' Your Identity

BOSTON (CBS) - With all of the massive data breaches at companies like Equifax, there is a better chance than ever a thief will steal your identity and try to cash in on a fraudulent tax return.

It's not only a multi-billion-dollar problem for the Internal Revenue Service (IRS), it is also a huge headache for innocent taxpayers.

Just ask Julianne McLaughlin, who spent months trying to remedy an identity theft dilemma for her elderly parents.

"It was very stressful," she told WBZ. "I would say it was a 10 on a scale of 10 in terms of bureaucracy."

The issue started in March when the IRS sent a letter, saying the agency needed to verify the identity of her parents prior to processing their tax return.

Her mother, Julianne O'Connor, lives in a senior retirement community in Duxbury. Her father suffers from late-stage Alzheimer's and lives in a memory care facility a few miles away.

"I was wondering why they needed to be verified. They've been filing taxes for almost 70 years," explained McLaughlin, who handles the financial affairs for her parents.

McLaughlin figured it was some kind of random IRS audit. She followed the instructions and sent the previous three years of tax returns, along with other documentation.

But then another IRS letter arrived that the response was not sufficient. McLaughlin tried again. Still not good enough.

Efforts to resolve the situation on the phone were not successful, either. Every time McLaughlin called the IRS hotline, she could not get through. In one instance, the family's elder law attorney waited on hold for two hours.

McLaughlin finally made an appointment with the IRS customer service center in Brockton and brought her 85-year-old mother to the office early on an October morning.

It was during that meeting that McLaughlin learned someone had stolen her elderly parents' social security numbers and used them to file a fraudulent tax return. The revelation occurred about seven months after the first IRS letter had arrived in the mail.

"I was completely shocked," she recalled. "I just remember my heart pounding and wondering who else out there had the information."

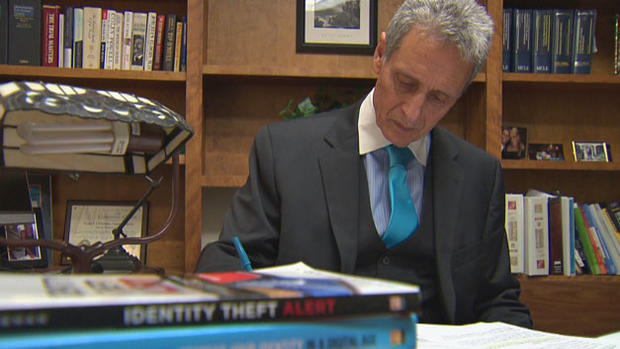

Steve Weisman, a professor at Bentley University, said taxpayers should assume that if they get a "verification" letter from the IRS, they are likely victims of identity theft.

Weisman, who has written several books on the topic, said the IRS is notoriously slow to inform taxpayers they are at risk.

"It's such a bureaucratic nightmare that they don't let you know as soon as possible that you're a victim," he told WBZ. "It makes it difficult to straighten it out and get your refund."

According to a recent report by the Office of the National Taxpayer Advocate (NTA), during the busy filing season, callers had less than a one in 10 chance of getting through to an IRS employee on the phone.

The NTA also criticized the IRS for bouncing taxpayers around to several different people, instead of assigning a sole point of contact.

Out of cases it reviewed, the NTA found it took an average of 278 days – or about nine months – to resolve. The IRS tells taxpayers to expect a 180-day timeframe.

A recent Government Accountability Office report found the agency did improve its telephone service with increased staffing levels.

"The IRS has worked hard to help victims of identity theft by making improvements and shortening the time it takes to resolve these complex situations," the agency says on its web site.

Weisman told WBZ that identity theft can be especially problematic for senior citizens because their social security numbers also represent their Medicare numbers. That opens up the possibility of health insurance fraud and the mixing of medical records.

"The stakes are higher," Weisman said. "It can potentially be deadly to a senior."

After months of trying to cut through the red tape, O'Connor's refund check finally arrived this month. She wonders what would happened if her daughter hadn't been available to help.

"Get someone to help you through the process," she advised to other seniors. "When you're dealing with a big bureaucracy, you have to keep plodding along."

Experts say identity theft victims should immediately file a police report, fill out an IRS identity theft affidavit, and send those in with their paper return. Those steps can dramatically cut down on the time it takes to resolve a case.

The best piece of advice? Don't procrastinate doing your taxes. That way, you increase your odds of beating identity thieves to the punch and getting your tax return on time.

Even though the tax refund has arrived, McLaughlin is still worried about the potential financial damage done to her elderly parents during the long IRS delay.

"If you think for any reason that somebody might be the victim of ID theft, you need to let them know immediately," she said.

Ryan Kath can be reached at rkath@cbs.com. You can follow him on Twitter or connect on Facebook.