Insurance Basics: Homeowners

BOSTON (CBS) - For most folks, your home is the largest tangible asset you own. You need to protect it with insurance.

When you purchase homeowner's insurance you usually get coverage for lots more than the structure of the house.

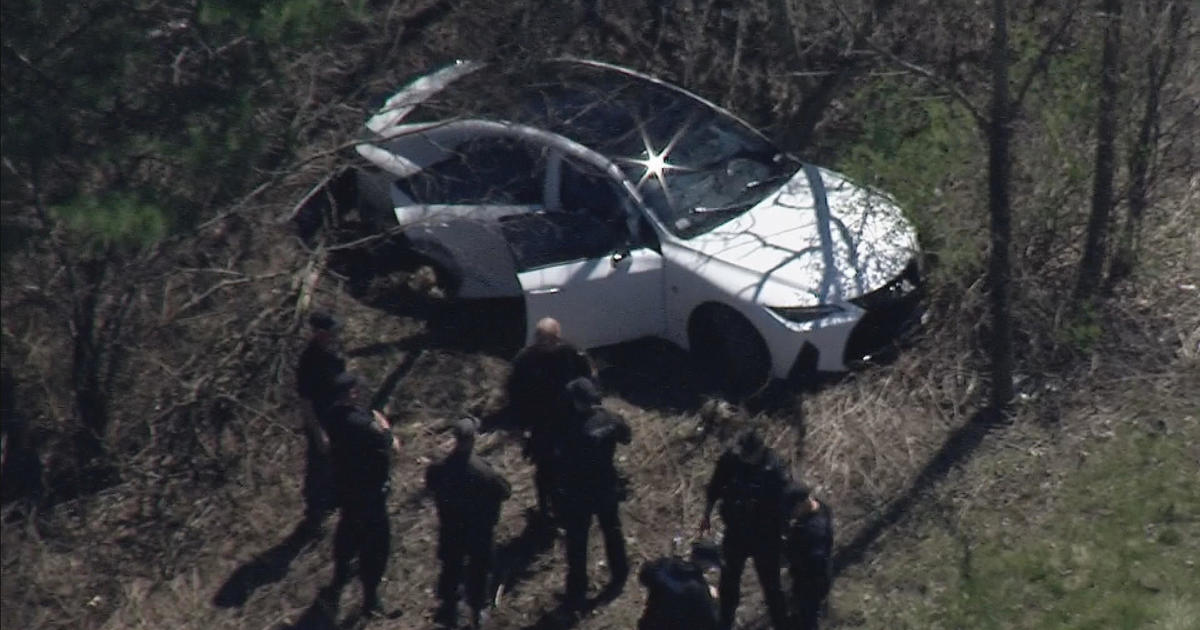

Most of us own an HO3 policy and it covers you against fire, lighting, wind, hail, explosions, riots, aircraft wrecks, vehicle wrecks, smoke, vandalism, theft, breaking glass, falling objects, weight of snow or sleet, collapsing buildings, freezing of plumbing fixtures, electrical damage and water damage from plumbing, heating and air conditioning systems to the basic structure of the home or out buildings such as a detached garage or shed.

A standard homeowner's policy does not cover terrorism, acts of war, nuclear accidents, earthquakes, floods or extensive mold damage.

It does cover the contents of your home usually up to an amount equal to 50% of the value of the home.

And will cover your personal items even if something happens to them when you have removed them from the home, such as your kid goes off to college or your golf clubs are stolen from your car.

Your policy will provide some limited liability insurance. If someone is injured on your property or harmed by something you own like a biting dog or your snow mobile you can be held liable for such injuries.

Collectibles such as antiques, oriental rugs, coins and stamps are not normally covered. There is often an internal limit to how much an insurance company will pay for such things as jewelry so you will need to purchase extra insurance in the form of a rider to your policy for anything of value not covered.

To help lower your insurance premium be sure to have smoke alarms, carbon monoxide detectors, improve your home security, bundle your home and auto policies from the same insurer, raise your deductible, maintain a good credit report and score, live near a fire hydrant. And ask if there is a discount if you are over 55.

If you work at home, you want to be sure you have coverage for your equipment and any liabilities that might arise due to your home office.

....................

You can hear Dee Lee's expert financial advice on WBZ NewsRadio 1030 each weekday at 1:55 p.m., 3:55 p.m., and 7:55 p.m.

Subscribe to Dee's Money Matters newsletter here.